Fica tax rate calculator

FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings. What is FICA tax.

Easiest 2021 Fica Tax Calculator

And if youre in the construction.

. Lets say your wages for 2022 are 135000. Ad Looking for how to calculate fica taxes. Both employees and employers pay FICA taxes at the same rate.

Over a decade of business plan writing experience spanning over 400 industries. Social Security and Medicare Withholding Rates. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified.

All Services Backed by Tax Guarantee. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. The maximum an employee will pay in 2022 is 911400.

Our free online FICA Tax Calculator is a super easy tool that makes it easy to calculate FICA tax for both those who are an employee and those who are self employed. Ad Build Your Future With A Firm That Has 85 Years Of Investing Experience. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Colorado Unemployment Insurance is complex. The HI Medicare is rate is set at 145 and has no earnings. Self-employed individuals pay a self-employment tax which is the equivalent of FICA tax.

2 or 62 would be deducted from the employees gross earnings and would be filed with the IRS. Content updated daily for how to calculate fica taxes. For 2022 they will pay a 153 OASDI tax the old age survivors and disability.

FICA taxes are divided into two parts. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Since the rates are the same for employers and.

You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates. In 2022 only the first 147000 of earnings are subject to the Social Security tax. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400. 2 or 62 would be applied against the employers payroll tax for that cycle. It changes on a yearly basis and is dependent on many things including wage and industry.

Social Security tax and Medicare tax. The Social Security tax rate is. Stock Market Investing Online Calculators Valuation.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. The nice thing about calculating FICA as part of your payroll processes is that there are very few variables.

Our income tax calculator calculates your federal. The current rate for. How is FICA calculated.

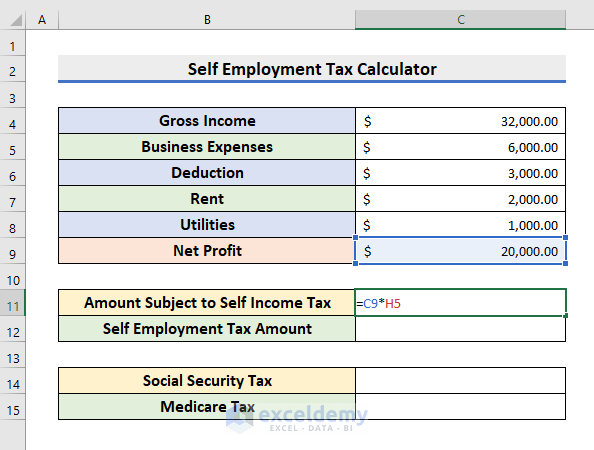

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

How To Calculate Payroll Taxes For Your Small Business

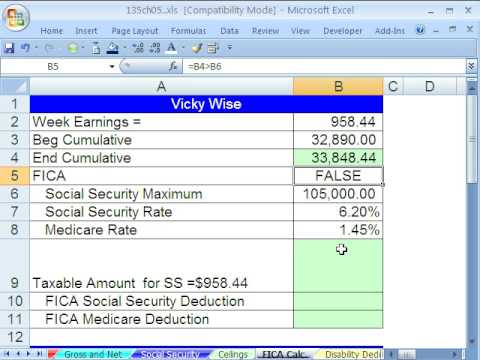

Excel Busn Math 41 Payroll Deductions With Ceilings Fica Youtube

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Easiest 2021 Fica Tax Calculator

Solved W2 Box 1 Not Calculating Correctly

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Social Security Tax Calculation Payroll Tax Withholdings Youtube

What Is Fica Tax Contribution Rates Examples

Federal Income Tax Fit Payroll Tax Calculation Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Tax Calculator Estimate Your Income Tax For 2022 Free

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

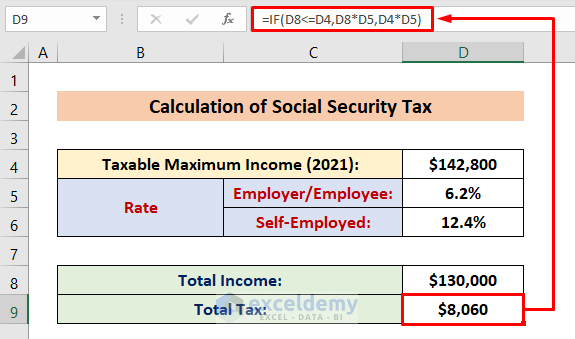

How To Calculate Social Security Tax In Excel Exceldemy

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Excel Business Math 34 Median Function For Fica Social Security Medicare Payroll Deductions Youtube